How to analyze a real estate deal is a crucial skill for anyone looking to invest wisely in property. With the right knowledge and tools, you can navigate the complexities of real estate transactions and make informed decisions that maximize your returns. Understanding the nuances of market research, financial metrics, and the roles of real estate professionals can significantly enhance your investment strategy.

This guide will walk you through the essential components of a real estate deal, the importance of collaborating with industry experts, and various investment strategies to help you assess potential properties effectively. Whether you’re a novice or a seasoned investor, mastering these concepts will empower you to approach real estate with confidence.

Understanding Real Estate Deals

Analyzing real estate deals involves a careful evaluation of multiple factors that influence the potential success of a property investment. Investors must grasp the essential components that comprise a real estate transaction, the role of thorough market research, and the financial metrics that drive decision-making.The critical components of a real estate deal include the property type, location, condition, and the terms of the sale.

Each of these elements can significantly impact an investor’s potential return on investment (ROI). Understanding the interplay between these factors helps investors strategically position themselves in the market and make informed choices when evaluating opportunities.

Importance of Market Research in Evaluating Properties

Market research plays a pivotal role in assessing the viability of real estate investments. It involves analyzing current market trends, property values, neighborhood demographics, and economic indicators that could affect property performance. A solid understanding of the market informs investors about potential risks and rewards.Key aspects of market research include:

- Comparative Market Analysis (CMA): This technique evaluates similar properties in the area to determine a fair market value. A CMA considers various factors such as square footage, location, and amenities.

- Market Trends: Analyzing trends helps investors understand whether the market is in an upward or downward cycle, indicating the potential for appreciation or depreciation.

- Demographics: Understanding the population characteristics of a neighborhood, including income levels, age distribution, and employment rates, can provide insights into rental demand and property value stability.

Financial Metrics Used in Real Estate Transactions

When analyzing a real estate deal, several financial metrics come into play, each providing valuable insights into the potential performance of the investment. These metrics allow investors to assess risks and returns quantitatively.The most commonly used financial metrics include:

- Cash Flow: This metric represents the income generated from a property after deducting all expenses. Positive cash flow is desirable as it indicates the property is generating profit.

- Capitalization Rate (Cap Rate): Calculated as the ratio of net operating income (NOI) to the property’s current market value, the cap rate helps investors gauge the potential return on investment.

- Return on Investment (ROI): ROI measures the profitability of an investment and is calculated by dividing the net profit by the total investment cost. It provides a clear indication of the investment’s efficiency.

- Internal Rate of Return (IRR): This metric estimates the profitability of potential investments by calculating the rate at which the net present value of cash flows equals zero, making it a crucial tool for long-term investment analysis.

The formula for Cash Flow is: Cash Flow = Income – Expenses.

By utilizing these financial metrics, investors can make data-driven decisions that align with their investment goals, ensuring they are well-equipped to navigate the complexities of real estate transactions.

Role of Real Estate Professionals

Real estate professionals play a crucial role in guiding clients through the complexities of property transactions. Their expertise can significantly influence the success or failure of a real estate deal, making it essential to understand their responsibilities and how to effectively collaborate with them.Real estate agents and realtors are tasked with various responsibilities throughout a deal. They act as intermediaries between buyers and sellers, providing valuable market insights, property evaluations, and negotiation expertise.

Their understanding of local real estate laws and market trends is instrumental in helping clients make informed decisions. They also handle the marketing of properties, manage showings, and facilitate communication between all parties involved.

Responsibilities of Real Estate Agents and Realtors

The responsibilities of real estate agents and realtors can be categorized into several key areas:

- Market Analysis: Agents conduct thorough market research to evaluate property values, ensuring clients understand current trends and pricing.

- Property Listings: They create and manage property listings, showcasing the unique features of each property through professional photography and compelling descriptions.

- Negotiation: Skilled negotiators, they advocate for their clients’ interests, striving to secure the best possible deal.

- Legal Guidance: Agents provide insights into contracts and legalities involved in real estate transactions, helping clients navigate potential pitfalls.

- Networking: Their extensive network of contacts, including other agents, inspectors, and lenders, can facilitate smoother transactions.

Best Practices for Collaborating with Real Estate Professionals

Effective collaboration with real estate professionals can enhance the transaction experience. Here are some best practices to consider:

- Clear Communication: Establish open lines of communication to ensure all parties are on the same page regarding expectations and timelines.

- Set Goals: Clearly Artikel your objectives and desired outcomes to guide the agent’s efforts in finding suitable properties or buyers.

- Be Available: Make yourself accessible for questions or updates to expedite the process and address concerns promptly.

- Trust Their Expertise: Rely on their knowledge and experience in the market, and be open to their suggestions regarding pricing and property features.

Differences Between Residential and Commercial Real Estate Agents

Understanding the distinctions between residential and commercial real estate agents is vital for a successful transaction in either sector:

- Specialization: Residential agents focus on homes and personal real estate transactions, while commercial agents specialize in properties intended for business use, including office buildings and retail spaces.

- Market Dynamics: The residential market is often influenced by personal preferences and emotional factors, while the commercial market is driven by financial metrics and investment potential.

- Transaction Complexity: Commercial transactions tend to be more complex, involving detailed financial analysis and longer negotiation processes compared to residential deals.

- Client Base: Residential agents typically work with individual buyers and sellers, whereas commercial agents engage with businesses, investors, and larger entities.

Investment Strategies in Real Estate

Real estate investment offers a multitude of strategies tailored to diverse financial goals and risk appetites. By understanding these strategies, investors can optimize their approach to generate significant returns. Three popular investment strategies are flipping, renting, and wholesaling, each with its unique processes and considerations.

Flipping Properties

Flipping involves purchasing properties with the intent to renovate and sell them for a profit within a short timeframe. This strategy demands an acute understanding of the real estate market, renovation costs, and timing. Successful flippers often look for distressed properties at below-market prices and seek to add value through improvements.

- Market Research: Investigate local market trends to identify high-demand areas.

- Property Acquisition: Secure a property at a price low enough to allow for renovation costs and profit margin.

- Renovation Plan: Develop a budget and timeline for renovations that enhance property value.

- Marketing Strategy: Plan effective marketing techniques to attract buyers swiftly once the property is ready.

- Sale Execution: Work with real estate agents or platforms to maximize visibility and secure the best sale price.

Renting Properties

Renting is a long-term investment strategy that focuses on acquiring property to generate rental income. This strategy is ideal for investors looking for a steady cash flow and long-term appreciation of property value.

- Property Selection: Choose properties in desirable locations with high rental demand.

- Financial Analysis: Calculate expected rental income against mortgage and maintenance costs to ensure positive cash flow.

- Tenant Management: Screen potential tenants thoroughly to mitigate risks and ensure timely rent payments.

- Property Maintenance: Regularly maintain the property to uphold its value and tenant satisfaction.

- Legal Compliance: Stay updated on local landlord-tenant laws to avoid legal issues.

Wholesaling Real Estate

Wholesaling involves finding a property under market value, securing it under a contract, and then selling the rights to that contract to another buyer for a fee. This strategy requires little capital and is often viewed as a low-risk entry into real estate investing.

- Lead Generation: Utilize marketing techniques to find potential distressed properties.

- Negotiation Skills: Master negotiation to secure properties at the lowest possible price.

- Contract Assignment: Draft a contract that allows for the assignment of the purchase agreement to another buyer.

- Buyer Network: Build a network of investors ready to purchase contracts quickly.

- Closing Process: Ensure a smooth transaction process for the end buyer to maintain professional credibility.

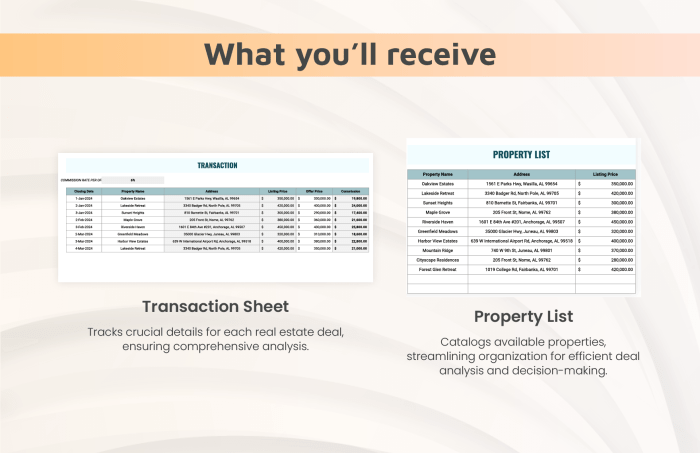

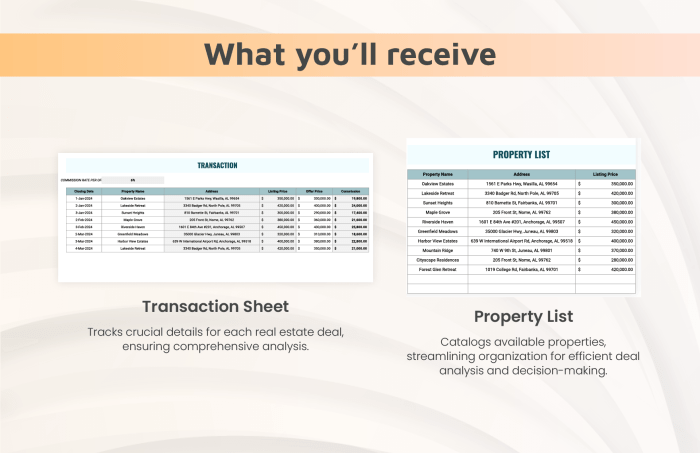

Analyzing Potential Investment Properties

The process of analyzing investment properties is crucial to ensure profitability. A structured approach can simplify this task.

- Property Evaluation: Examine the property’s condition, location, and market trends.

- Financial Assessment: Calculate potential returns using metrics such as cash-on-cash return and cap rate.

- Comparable Sales Analysis: Review recent sales of similar properties in the area to estimate fair market value.

- Risk Assessment: Identify potential risks, including market volatility and property management challenges.

- Investment Goals Alignment: Ensure the property aligns with your overall investment strategy and goals.

Evaluating Commercial vs. Residential Properties

Investing in commercial and residential properties involves different considerations and potential returns. Here’s how to evaluate both types effectively.

- Market Demand: Research local demand trends for both commercial and residential spaces.

- Funding and Financing: Understand the different financing options available for commercial versus residential investments.

- Return on Investment: Analyze potential returns, noting that commercial properties often yield higher returns but come with increased risk.

- Lease Structures: Consider the type of lease (e.g., gross vs. net) and its implications on cash flow.

- Management Requirements: Assess the property management needs and how they differ between commercial and residential properties.

Final Conclusion

In conclusion, knowing how to analyze a real estate deal is vital for success in the property market. By grasping the key components, leveraging professional insights, and employing effective investment strategies, you position yourself to make smarter, more profitable decisions. Remember, the right analysis can turn a potential risk into a rewarding opportunity.

Question & Answer Hub

What are the key metrics to analyze in a real estate deal?

Common metrics include cash flow, return on investment (ROI), cap rate, and gross rental yield.

How important is market research in real estate analysis?

Market research is crucial as it helps you understand demand, pricing trends, and potential investment risks.

What should I look for when evaluating a property?

Consider location, condition, potential for appreciation, and local market conditions.

How do I choose the right real estate professional?

Look for experience, local market knowledge, and a good track record of successful transactions.

What investment strategy is best for beginners?

Renting is often considered a safer entry point, providing steady cash flow while building equity.